By: Jennifer Pacilli, CPA, Director

**Note: We’ve updated all financial references to tax years 2023 and 2024**

The role of a certified public accountant has changed quite a bit from when I first entered the profession. Today’s CPAs are advisors who assist clients with navigating through constantly-changing and complex tax laws. It has become increasingly difficult for individuals to sift through all the tax information out there and determine what applies to them. What is often overlooked is fundamental accounting advice that can save you time, money and aggravation. Here is some advice I have shared with my clients through the years. It bears repeating every year too!

Keep Good Records and Update as Needed

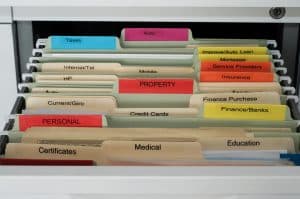

- Stay organized. Taking the time to organize your tax and financial records can make the annual tax filing process faster and easier. Furthermore, your accountant may be charging you more because of the condition of your records. Create a set of manual file folders or invest in a digital filing system to sort and separate your documents. Don’t wait until year-end to gather your documents; rather, file or upload documents as you receive them. Use your prior year’s tax return as a starting point to determine your previous income, deductions and credits reported. Carefully check your mail in late January for tax documents and review credit card and bank statements for deductible items, such as business expenses and contributions. Lastly, know where your support documents are and be sure to document everything in case of an audit.

If you are self-employed, no matter what size business you have, it is extremely important to keep good records. It is best to use an accounting software program to track income and expenses. Additionally, all businesses should have a separate bank account(s) and credit card(s) to prevent comingling of business and personal income and expenses.

- Update your records. Our lives change on a daily basis. Life events, such as a change in marital status, birth of a child, or death of a loved one, can have a significant impact from a legal, financial and tax standpoint if official records are not changed. I suggest to my clients that they review their will, beneficiaries, retirement plans, and health directives annually to ensure all records are up to date.

- Maintain a calendar record. Keeping a calendar record comes in handy where the number of days is relevant in determining tax liability. For example, many businesses continue to offer flexible remote work options for employees. Your tax advisor will need a breakdown of days worked in the office versus remotely to determine if you are eligible for a tax benefit.

Let’s say you own rental property that is used for both rental and personal purposes. Tracking the actual days the property is rented will help determine the amount of expenses you can deduct to offset rental income.

Finally, divorced taxpayers who share joint custody of their children should keep a calendar each year that tracks the number of nights the children slept in their home. There are 365 days in a year, not 364 days. The IRS doesn’t care what is written in the child custody agreement. The taxpayer who has physical custody for 183 days is the custodial parent. In the case of a dispute between the parents, the calendar will be needed to prove the custodial parent who is entitled to claim the children.

Save. Save. Save.

There are many savings strategies that come with significant tax benefits. Work with your tax advisor to determine the best options for you.

- Max out your retirement contributions. Less taxable income means less tax owed. Making contributions to a retirement account is a great way to reduce taxable income. Individuals have several options to choose from:

- Company-sponsored 401(k) plans offer a significant benefit because employers often match contributions. Try increasing your 401(k) contribution so that you are investing the maximum amount of money allowed ($22,500 for 2023, plus an extra $7,500 if you are age 50 or over) – OR – ($23,000 for 2024 plus an extra $7,500 if you are age 50 or over). If you can’t afford that much, try to contribute at least the amount that will be matched by your employer. Also, increase your annual contributions every time you receive a raise.

- If you don’t have access to a company 401(k), consider contributing to an IRA. In order to qualify for a deduction, the contribution needs to be made by the tax return due date, NOT including extensions). You can contribute a maximum of $6,500 to an IRA in 2023 ($7,000 in 2023), plus an extra $1,000 if you are age 50 or older.

RELATED: RMD Relief and Guidance for 2023

- If you’re self-employed, consider investing in a Simplified Employee Pension (SEP). You can contribute as much as 25% of your net earnings from self-employment, up to $66,000 for 2023 ($69,000 for 2024). In this case, contributions can be made by 10/15 with a valid extension.

- If you are currently in a low income tax bracket, consider Roth 401(k) and Roth IRA contributions first. There is no tax benefit in the year of contribution but the earnings grow tax free and qualified distributions are not subject to tax.

- Contribute to a Health Savings Account (HSA). If you have a high-deductible health care plan, you can reduce your taxable income by contributing to an HSA. The withdrawals are tax-free as long as you use them for qualified medical expenses. The 2023 contribution limits are $3,850 for individual coverage and $7,750 for family coverage. The 2024 contribution limits are $4,150 for individual coverage and $8,300 for family coverage. Account owners age 55 or older can make an additional $1,000 contribution annually.

RELATED: New Rules and Ways to Use HSAs/FSAs

- Start early to save for college. An easy strategy to save for your child’s education if you don’t earn a lot of money is to dedicate the refund from the annual child tax credit to fund a 529 Plan for the child’s education. Earnings will grow tax free and the distributions are not subject to federal tax as long as they are used for qualified education expenses.

Get the Timing Right

Taking action before year-end can make a substantial difference in your taxes. There are opportunities for you to control the timing of deductions and/or income to reduce your tax liability.

- Bundling deductions. The goal of bundling is to position yourself so that you will have deductions greater than the standard deduction one year with the following year being a standard deduction year. By itemizing deductions every other year, you can minimize your tax liability. Some ways to bundle deductions include:

- Make an additional mortgage payment during the calendar year. For example, make the January 1st mortgage payment by December 31st of the current year. This gives you 13 months of deductible mortgage interest.

- If you know you are near the threshold for the medical expenses deduction, move a medical or dental procedure you’ve been putting off to the year you are itemizing deductions.

- Make a contribution to a Qualified Charitable Fund (QCF). By committing a larger contribution to a QCF, the contribution is deductible in the year made but the money can be disbursed to the intended charity over two years.

- Accelerate or defer income and deductions. For individual taxpayers, income is taxed in the year it is received and expenses are deductible in the year paid. Generally, if you are in a high tax bracket in the current year and expect your income to be substantially less next year, you may want to consider strategies that will defer taxable income until the next year, such as waiting to sell appreciated stock. You can use the same strategy for your deductions and pay them in the tax year in which you will receive the greatest tax benefit. Work with your tax advisor to determine the best strategy for your situation.

Consider a Qualified Charitable Distribution (QCD).

A QCD is a tax benefit that allows owners of individual retirement accounts to transfer funds from their pre-tax IRA directly to qualifying charities. The donated funds can count toward satisfying the annual required minimum distribution but are excluded from income, thereby reducing adjusted gross income. The maximum annual amount that can qualify for a QCD is $100,000. If both spouses are age 70 1/2 or over when the distributions are made and both have IRAs, each spouse can exclude up to $100,000 for a total of up to $200,000 per year. NOTE: Beginning in 2024, the annual QCD cap will be indexed to inflation, which will allow doners to give even more from their IRAs directly to charities. Discuss with your tax advisor to determine if a QCD is right for you.

RELATED: Tax Implications of Charitable Planning/Giving Strategies [Updated Jan 2023]

Surround Yourself With a Good Team.

No matter what stage you are at in life or business, it is important to surround yourself with a team of trusted advisors who are familiar with your overall financial health. Your team should include an attorney, financial advisor, and, of course, an accountant. They should work together on a plan to help you achieve your financial goals. Additionally, make sure you consult with all your advisors before you execute a significant transaction. It costs less to pay for tax planning up front than it does to pay for damage control later.

With sound planning, good organization and expert guidance from trusted advisors, you can save yourself time, money and aggravation at tax time. Meet with your team before the end of the year to discuss and implement some of the suggestions in this article to impact your 2023 taxes, as well as to plan for 2024.

Jennifer Pacilli is a Director in the Tax Department of Cover & Rossiter. With over 26 years of experience in public accounting, Jennifer applies her expertise to assist many of the firm’s most complex and diverse corporate, individual and international clients.