Factors to Consider if Converting from a Traditional IRA to a Roth

By: Kimberly Zarett, CPA, MS, Principal

2020 has certainly been a year unlike any other. In terms of protecting one’s retirement nest egg, some opportunities have been introduced to certain investors to save and invest differently for the future. The purpose of this communication is to provide information on the advantages and disadvantages of converting funds from a traditional IRA account to a Roth IRA. We strongly encourage you to reach out to your investment retirement team, e.g. your financial adviser, accountant, attorney, etc., to discuss in greater detail and make a decision that best suits your situation.

Traditional IRA accounts have some downsides. In most years, there are annual minimum distributions required from these accounts. Depending on the IRA account balance, these distributions could be quite large. As a result, the increase in income from the distributions could push you into a higher tax bracket. The increase in income could also cause favorable long-term capital gains to be taxed at higher rates, more social security income could be subject to tax, and you may become subject to the 3.8% net investment income tax. Traditional IRA accounts are also the highest taxed accounts left to beneficiaries, as there is no step-up available as compared to other accounts, such as a brokerage account.

The Roth IRA account, on the other hand, has no required minimum distributions and qualified distributions are free from income tax. In anticipation of rising tax rates, many are considering converting at least some portion of a traditional IRA account to a Roth account. Even before the COVID-19 pandemic, tax rates were already scheduled to increase at the end of 2025. The national debt is at record levels, and further relief measures to combat the devastating impact of COVID-19 will only cause the debt to rise. There is wide speculation that tax rates will be rising in the near future.

There is often a fear that the cost of conversion will not reap a benefit, or could even result in a loss. There is no opportunity cost in terms of lost investment gains if the tax rates and earnings are the same both at conversion and later at distribution. Let’s look at two examples to reinforce this point.

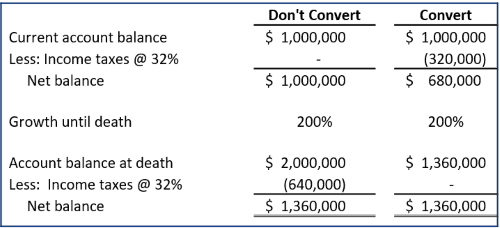

Example #1: Annie, a married taxpayer filing a joint return, has a $1,000,000 traditional IRA. Assume that the $1,000,000 will double in value by the time Annie retires and she is in the 32% marginal income tax bracket. The chart below compares the net after-tax wealth:

In the above example, there is no harm to converting as the net balance of the IRA will be the same. If, however, the tax rate is lower at the time of conversion versus the time funds are withdrawn from the Roth IRA, the conversion will be favorable.

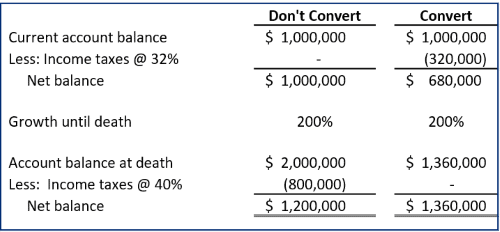

Example #2: Let’s assume tax rates increase and Annie will be in a marginal tax bracket of 40%. As you can see from the figures below, the Roth IRA account balance will be $160,000 higher than the traditional IRA account.

How much should you convert? Determining the amount you can afford to convert is generally dependent on two factors: (1) the effect on your tax rate, and (2) the means for paying the taxes on the conversion amount. The amount converted is added to your current year taxable income, which could potentially bump you into a higher bracket. Proper planning can be done to determine the appropriate amount to convert, without pushing you into the next bracket. While taxes on the conversion can be paid from IRA funds, that portion would be considered a taxable distribution, potentially subject to an early withdrawal penalty if made before age 59 ½. Clients who have the ability to pay the tax with non-IRA funds will reap greater benefits.

Additional considerations before doing a Roth conversion. Because there could be a large jump in taxable income in one year, there could be limitations on the availability of certain deductions that are tied to income, such as medical expenses, real estate losses, and the QBI deduction. In addition, the 3.8% net investment income tax could be triggered or social security benefits become taxable. If you are on Medicare, there can be impacts on the surcharges for Part B and Part D premiums.

Summary. Some have opined whether 2020 is the “perfect storm” for Roth conversions. Volatility in the markets can work in your favor. Furthermore, lower income due to unforeseen business losses resulting from COVID-19 can make the tax on a conversion less than anticipated. The key to successful Roth IRA conversions is managing income within the brackets. Perhaps it is time to do planning and determine if converting some amounts over the next several years makes sense. Again, we strongly advise you to consult with your retirement investment team before year end. If you are a Cover & Rossiter client, reach out to your C&R tax advisor to discuss your options.

Additional Resources: https://www.kiplinger.com/retirement/retirement-plans/roth-iras/601774/your-guide-to-roth-conversions

Additional Resources: https://moneyandmarkets.com/roth-ira-conversion/